The ESG Risk Insight Tool is based on an in-depth content analysis of annual reports published by a selection of Eurostoxx companies between 2016 and 2023.

Sentences concerning financial risks or risks outside the NFRD scope were excluded.

This multi-dimensional approach enables the ESG Risk Insight Tool to capture both the extent and quality of ESG risk reporting, facilitating meaningful benchmarking across companies, sectors, countries, and years.

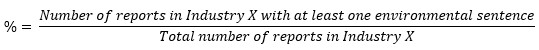

If both industry and country are selected (e.g., Manufacturing and Italy), the formula becomes:

![]()